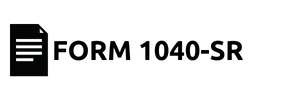

IRS 1040-SR Tax Form with Instructions

The IRS 1040-SR Tax Return Purpose & Meaning

Primarily targeted toward senior citizens, IRS 1040-SR printable form comes into play when preparing your 2023 tax return. It is a version of the widely-recognized IRS Form 1040, adjusted to account for the common types of income of individuals who are 65 or older. This special version of the 1040 return allows the tax filer to input their standard deductions vividly on the form, providing a comprehensive view of their financial situation.

Check Out New Instructions for Form 1040-SR for 2023

For many individuals, completing such forms can prove to be a hassle, which is where the value of 1040sr-form-instructions.com becomes evident. This website contains detailed IRS Form 1040-SR instructions for 2023, providing a step-by-step guide on correctly and efficiently filling out the return template. From providing an IRS Form 1040-SR example to offering the blank printable template, our website serves as an all-inclusive resource for senior citizens attempting to handle their taxes. This allows the user to thoroughly understand the process, ensuring an error-free, prompt submission.

IRS Form 1040-SR for Seniors: Basic Rules to Consider

As outlined in the IRS instructions for the 1040-SR, this form is specifically intended for citizens or residents aged 65 or older. In particular, it's designed to accommodate taxpayers who can benefit from an increased standard deduction and make income calculations from sources like Social Security and retirement plans easier.

As outlined in the IRS instructions for the 1040-SR, this form is specifically intended for citizens or residents aged 65 or older. In particular, it's designed to accommodate taxpayers who can benefit from an increased standard deduction and make income calculations from sources like Social Security and retirement plans easier.

Subsequently, let me depict Robert, a recently retired, 67-year-old resident of Chicago. After serving as a professor of finance for several decades, he spends his ample free time reading classic literature and scribing articles for renowned science magazines. Robert has various income streams, including his pension drawdown, Social Security benefits, and extra earnings from his literature contributions.

Subsequently, let me depict Robert, a recently retired, 67-year-old resident of Chicago. After serving as a professor of finance for several decades, he spends his ample free time reading classic literature and scribing articles for renowned science magazines. Robert has various income streams, including his pension drawdown, Social Security benefits, and extra earnings from his literature contributions.

Due to his age bracket, source of income, and assorted financial standpoints, under federal tax form 1040-SR instructions, Robert is an ideal candidate to file this document. By doing so, he can maximize his standard deduction, simplify his taxation logistics, and ensure he's adequately adhering to the necessary IRS rules concerning his retirement income.

Filling Out the Blank 1040-SR Form Hassle-Free

Understanding how to fill out the 1040-SR form is a vital part of personal finance management for seniors in the U.S. Acting on IRS tax form 1040SR instructions, one can become proficient at filling the template correctly and evade common errors.

Date to File the 1040-SR

In understanding the U.S. taxation system, one cannot emphasize enough the importance of following the instructions for the 1040-SR tax form. As per norms, April 15 is typically the due date to file these forms each year. However, the consequences of failing to adhere to these guidelines are harsh.

The Internal Revenue Service (IRS) imposes penalties on both late filings and incidences of fraudulent information. These penalties vary according to the severity of the offense, ranging from monetary fines to possible imprisonment, thereby underscoring the significance of truthful declarations and punctual submissions.

Tips to Fill Out the 1040-SR Tax Return Form Flawlessly

Errors can occur easily while filling out the IRS 1040-SR form. The most widespread mistakes revolve around inaccurate or incomplete information, such as incorrect personal details or miscalculations in income or deductions. Additionally, misclassifying income sources or claiming ineligible deductions or credits can cause setbacks in tax returns. Any misplacement of tappable retirement distributions may also destabilize your payable tax.

- Avoid mistakes by reviewing the IRS 1040-SR form instructions carefully.

- Consider using tax-preparation software which auto-calculates and cross-validates data to minimize errors.

- Double-check your personal information and all financial figures. Moreover, guarantee the correct categorization of your income or entitlement to claim deductions

Meticulous review is invaluable to achieve error-free completion of your 1040-SR form and safeguard your tax returns' smooth processing.

IRS Tax Form 1040-SR: Popular Questions

More 1040-SR Form Instructions for 2023

Please Note

This website (1040sr-form-instructions.com) is an independent platform dedicated to providing information and resources specifically about the 1040-SR form, and it is not associated with the official creators, developers, or representatives of the form or its related services.